Every app wants to capture more Gen Z users. They are digital natives, with 98% owning a smartphone. While the assumption may be that they spend most of their time on game apps and social media, it’s important to realize this generation is maturing. This group also has a very different reality as 2020 comes to a close, and new data about their online habits shows they are spending more time on shopping and finance apps.

So, how can app marketers in these categories attract and retain Gen Z? First, we’ll unpack the data and provide some industry insights based on our expertise.

Q3 2020 Gen Z App Usage Data

Here’s what we know about Gen Z app usage via a report from App Annie.

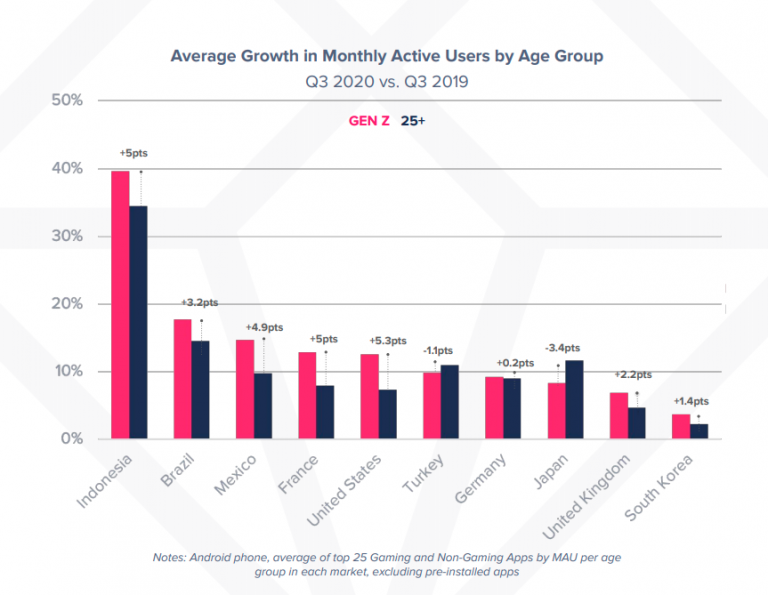

MAU Numbers for Gen Z Top Those Over 25

Comparing Q3 2019 and Q3 2020, Gen Zers average MAU (monthly active users) was greater than those older in almost every market. The U.S. had the largest difference at +5.3 points, followed by France and Indonesia.

Image: App Annie

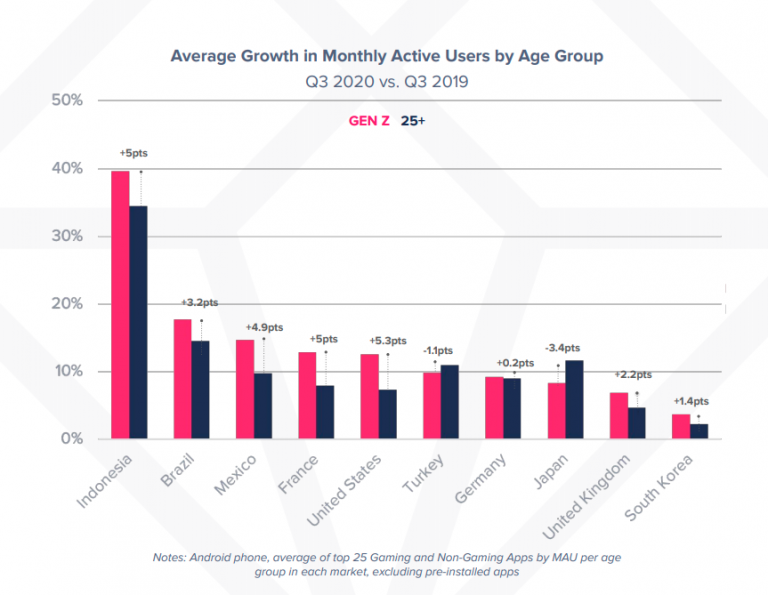

Gen Z Has Deeper Engagement in Non-Gaming Apps

They average 20% more sessions per user in top non-gaming apps versus older generations. In Q3 2020, they spent 4.1 hours a month in non-gaming apps, which was 10% longer than those over the age of 25.

Non-Gaming App Adoption Is Rising

So, where do they spend those hours? The two areas that had the highest growth were finance and shopping. These categories have struggled with reaching a broad Gen Z audience. Why the increase?

Image: App Annie

Shopping Apps That Gen Z Loves

So, what type of shopping apps appeal to Gen Zers and why? According to the data, Gen Z users have, on average, 20 shopping apps on their phones. The type is a mix of retailers and marketplaces, including SHEIN, ASOS, Shopee, Mercari, and Etsy.

This is not a group that’s going to follow in the footsteps of their parents. Celebrities also have less pull on what they like. In fact, 70% of teens trust influencers more than traditional celebrities. It makes sense. They’ve been on social media most of their lives.

Finance Apps Getting Gen Z’s Attention

In looking at the apps with Gen Z growth, most fall into the fintech world—Venmo, Monzo, or DANA. Branchless banks are popular as well. Another category is financial gateways that offer services from multiple banks. Toss in South Korea is killing it here.

How Can Shopping and Financial Apps Appeal to Gen Zers?

Now that we’ve unpacked the data, it’s time to get down to strategic opportunities to boost user acquisition (UA) for this group. How can shopping and financial apps appeal to Gen Z?

Design Matters

Digital natives that have had smartphones for most of their lives will not tolerate bad UX. They expect intuitive interfaces and seamless navigation. For both shopping and fintech apps, this means that the experience of looking at items must be smooth. Further, checkout must have as little friction as possible.

For finance apps, simple is better. Don’t overcomplicate things. Make onboarding easy with a guided approach. For any financial institution that is mobile-first, you have an opportunity to win over this generation. This generation craves ease and convenience. Many will begin to open bank accounts in the next few years, so a strategic push to attract them could be a win-win. Traditional banks will have to rethink how they market to this generation, including the possibility of having multiple app experiences.

Gamify to Engage

Gamification is often a way to enhance engagement in a variety of channels. Much of the way this generation’s learning experiences included gamification. Shopping and financial apps that can add some aspect of this could inspire loyalty. Some examples include Long Game and Qapital. They attempt to make finance and budgeting fun.

Tap Influencers to Be Your Ambassadors

Gen Z is serious about listening to influencers. It might be a smart move to find those that are trusted but also align with your brand. These could be influencers that provide honest, easy to consume advice about finances. It could be an upcoming lifestyle blogger that appeals to your target demographic.

If you’ve been hesitant to use influencers because of fears of negative ROAS (return on ad spend), performance-based social media influencer marketing is a good first step. In this model, an influencer posts a finely tuned message to drive app installs. They use a trackable link and only get paid when downloads are attributable to their posts. It’s a low-risk way to try out this approach.

Reconsider Your App Store Profile

If you want to attract and keep Gen Z users, your app needs to look like it fits their life and needs. You might need to change your lingo to match theirs. Research how they search for apps and try to capture that sentiment in your title, subtitle, and description. Make sure your visuals tell a story, as well.

Engage with Push Notifications and Chatbots, Not Email

Gen Z appreciates real-time communication, but they aren’t in love with email. They are more likely to open and interact with a push notification than email. In understanding the right channel to communicate, you can also personalize the message.

Understand What Matters to Them

This generation is truly unique, and they deeply care about authenticity and social responsibility. A study reported a few important starting points about Gen Z’s preferences:

- 79% respect brands more that use images not photoshopped.

- 84% trust companies more that promote actual customers in ads.

- 69% are more apt to purchase from brands that support charitable initiatives.

They have high expectations for an authentic experience with companies. If you want them to love your app, all your advertising campaigns should favor organic, genuine messages.

Ready to Capture More Gen Z Users?

If Gen Z isn’t on your radar; it should be. They have some similarities to millennials but are really a generation of their own. Reflecting on this new data about their app usage and how to appeal to them could help you tap into the market. Look to our team of experts for advice and customized strategies to get their attention. Get in touch today.