The world is waking up from the long slumber of the pandemic. This historical period of time ushered in once-in-a-lifetime shifts in consumer behavior. It directly impacted how users spend their time and money on their apps. With large-scale vaccine rollouts and people feeling secure engaging in activities again, what does this mean for mobile app advertising? What post-pandemic trends can the industry expect?

The Net Impact of Lockdown Was Good for Mobile Apps

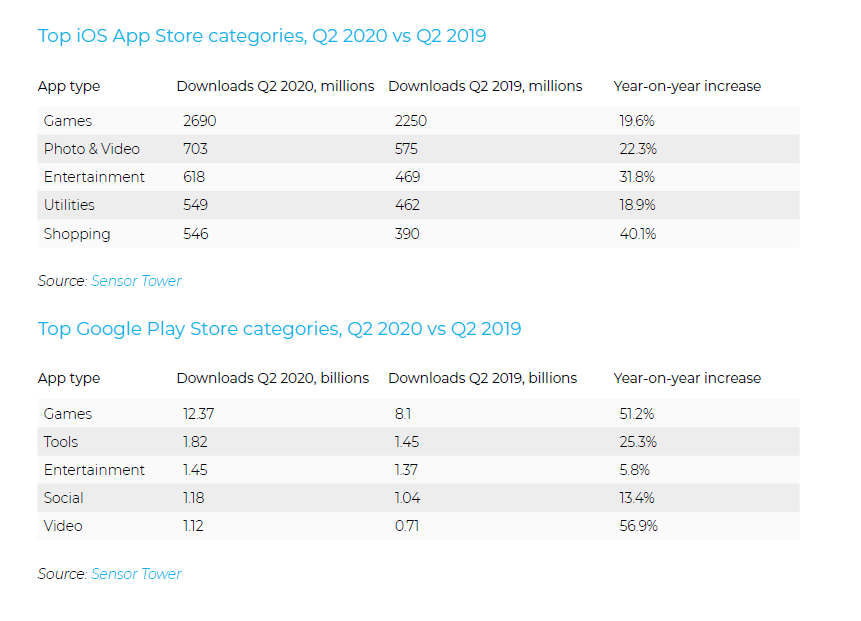

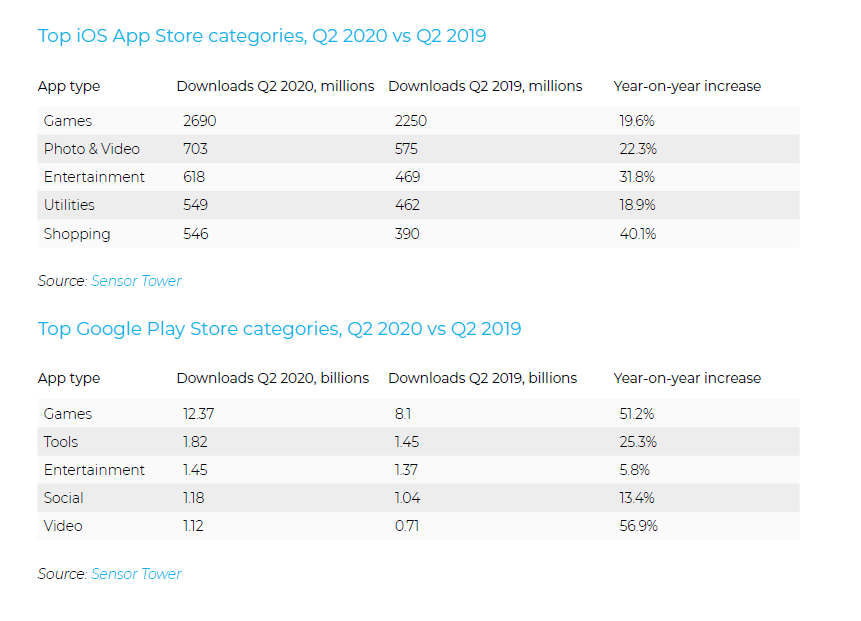

Many app categories experienced substantial gains in user acquisition (UA) and overall activity, with the winners being gaming, photo and video, entertainment, utilities, and shopping. Below are the numbers showing significant year-over-year growth, according to Sensor Tower data.

We also know that users spent more time in apps during 2020. Technology was the web holding everything together, and time on mobile devices increased, not solely because people were at home more playing games or streaming content. They were also working and learning from home, which often required app usage.

Not every app had great success. Uber tumbled because no one was going anywhere. Other similar apps tied to events, travel, or public interaction plummeted. Now, a completely new shift could be on the horizon.

4 Post-Pandemic Trends Likely to Impact Mobile App Advertising Now and Beyond

We won’t know the true impact of COVID-19 and the recovery from it for several years. However, there are some assumptions and predictions we can make based on data and observations. These trends are worth a look if you’re a mobile app marketer.

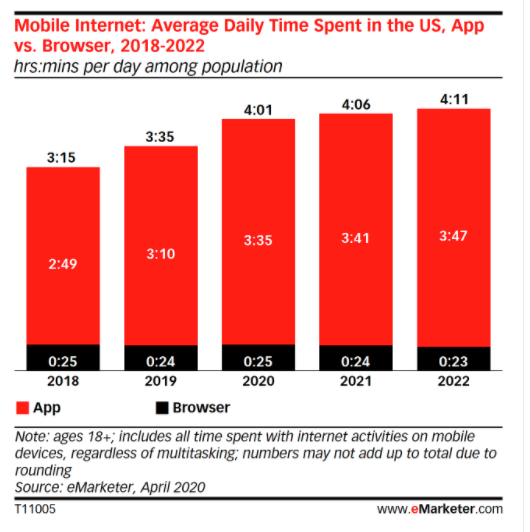

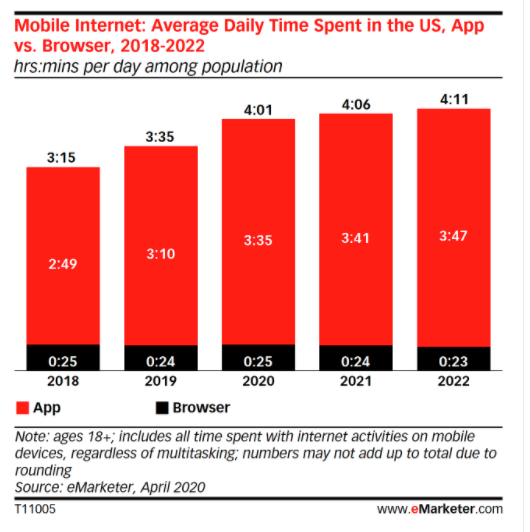

People Will Continue to Spend More Time on Apps than Browsers on Mobile Devices

The average daily time spent on mobile devices will be four hours and 6 minutes in 2021, with the majority, three hours and 41 minutes in apps. That will only increase in 2022.

This trend has been growing since before COVID-19, but there was a significant jump in 2020. The reality is that “there’s an app for that,” so the dependency on the browser wanes. Mobile app advertising will benefit from this shift, and when determining your market mix for UA, in-app advertising should likely get a larger piece of the pie than web-based campaigns.

Travel and Hospitality Apps Rebound

Everyone has cabin fever, and there is substantial pent-up demand for travel. Those consumers with minimal economic effects from the pandemic and feel safe will hit the road and air for the foreseeable future.

Domestic travel was predominant in 2020, but international destinations are now opening their borders. Expect domestic travel and road trips to remain in the lead for now.

Some consumers may not be leaving their metro area, but they will be venturing back to restaurants and local venues. This uptick in on-premises dining will remain steady, but delivery and curbside pickup aren’t going away either.

What does this mean for mobile app ad campaigns? Travel and hospitality apps have opportunities to gain new users with content-focused advertising tactics that appeal to consumers to use their app. Often these apps offer “special” pricing for those that book there versus the web. Leading with this incentive could increase downloads if you position them in digital properties that make sense.

You might also benefit from a burst campaign that emphasizes travel and dining keywords. This approach delivers a high volume of users, which can lead to organic uplift. Then your app will have more visibility on the charts for new users to find.

Dating Is Back, and So Are Apps That Seek to Help Make a Match

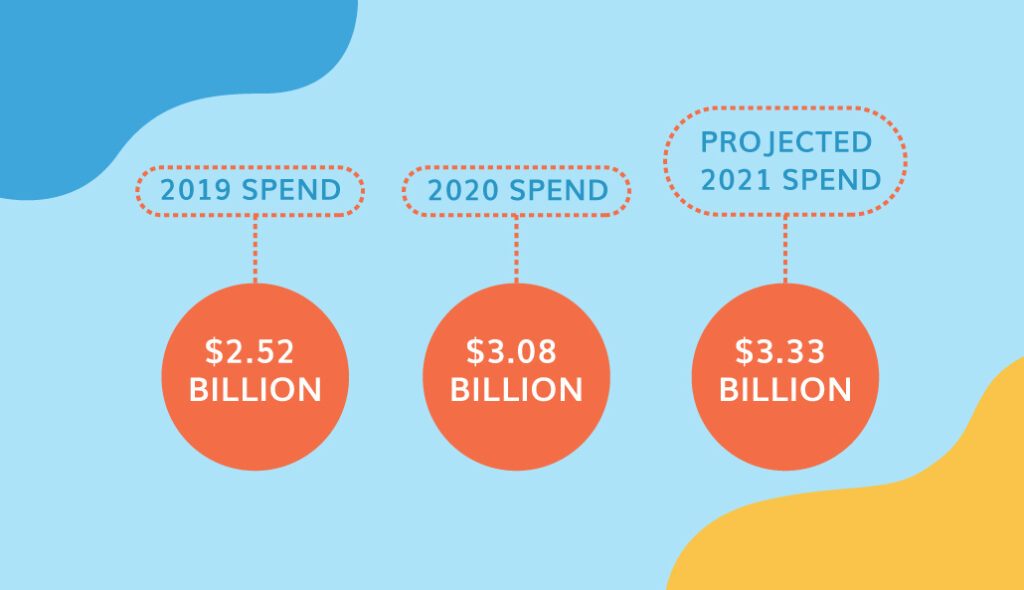

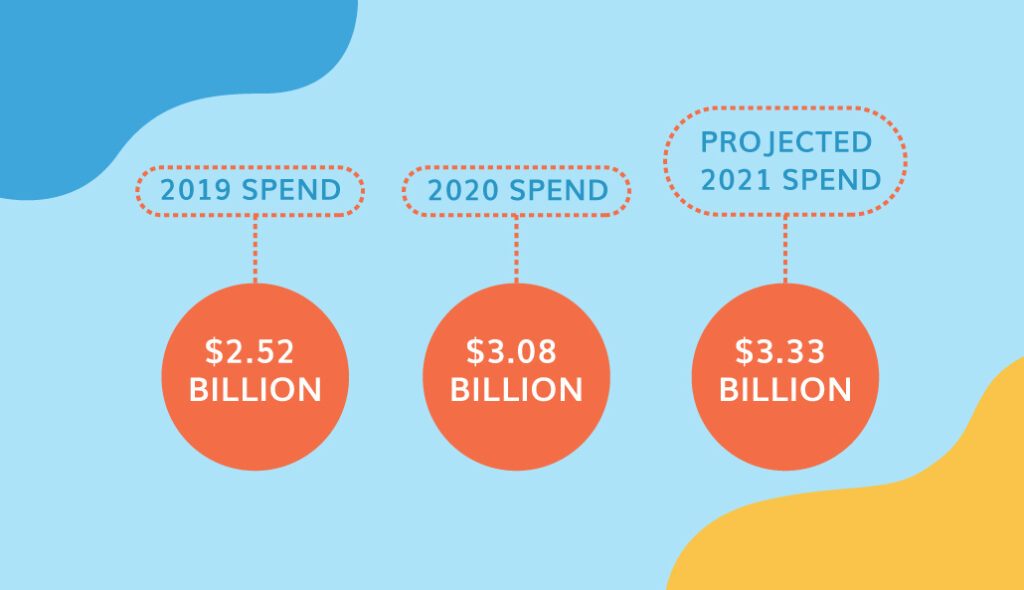

The dating scene in 2020 was bleak. However, there was an increase in users and spend in 2020. The 2021 projections look to see a bigger bump as consumers feel safer going out again.

Those leading the market, Tinder and Bumble, represent a more casual dating position and have more users than older sites like Match.com and Plenty of Fish. Here’s why this matters. Tinder and Bumble are mobile-focused apps. Older sites have apps but see usage on mobile and desktop. This could correlate to demographics, with younger generations using Tinder and Bumble and older ones creating profiles on Match.com and Plenty of Fish.

One possible additional reason for expected increased spending and use of dating apps is that the pandemic was a time of spikes in breakups and divorces. As a result, newly single individuals may be ready to find a new life partner.

Dating apps should consider UA strategies that target digital advertising opportunities where singles may spend time. They could also focus on the content of ads, speaking to the recently single who are getting a fresh chance at love.

Financial Apps Installs Keep Climbing

How consumers bank, manage money, and invest changed during the pandemic. Trends in behaviors caused fintech apps to grow their user base and retain them. Then there was the surge of investment apps at the beginning of 2021. Now, new data reveals that banking app installs were up 45% between Q1 2020 and Q1 2021. Apps spent over $3 billion on UA in 2020 to achieve these numbers. That’s not going to end just because the pandemic does. Consumers have new behaviors and are comfortable with their fintech apps.

For example, there’s very little reason for a customer to go into a branch anymore. Even if that was part of their routine pre-pandemic. They can do almost everything in the app, from depositing a check to bill pay to applying for a line of credit.

Additionally, investing is more accessible now by the masses. They don’t need a broker or financial planner. They simply need an app. This category of apps needs to continue the momentum by thinking outside of the norm around UA. Instead of just sticking to digital advertising options, consider offerwalls, which can work toward acquisition and retention.

How Will You Take Advantage of Post-Pandemic Mobile App Advertising Trends?

The trends that are the result of COVID-19 will influence mobile app marketing for years to come. This is only the surface of what will be a very dynamic and complex path. Based on what we know now and the data available, these trends are something to act on and leverage. And we can help. Connect with our app advertising experts today.